Bitcoin was born when Satoshi Nakamoto’s ground-breaking white paper was released on October 31, 2008.

It was a time of great turmoil in the United States and around the world. Americans were losing their homes due to the crash in the housing market. Many had lost a substantial part of their retirement and personal savings due to mortgage banks’ risky lending practices and Wall Street’s questionable investment products sold back and forth between major financial institutions.

Many of those major financial institutions deemed “too big to fail” would do just that with Americans left attempting to put the pieces of a shattered retirement back together again.

The trust people formerly placed on big banks, mortgage lenders, and their financial advisor was broken.

When murmurings of a new “trustless” system called Bitcoin began to surface, some investors began to listen.

To this day, the true identity of Satoshi Nakamoto is unknown. In his 9-page white paper, the mysterious creator of Bitcoin writes it is to be, “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Much of the mess of the 2008 financial crisis was due to inaccurate accounting, and irresponsible lending practices, which Bitcoin eliminates. Nakamoto continues, “We propose a solution to the double-spending problem using a peer-to-peer network…We have proposed a system for electronic transactions without relying on trust.”

The proposal behind Bitcoin, cryptocurrencies, and related digital technology is to accomplish 2 objectives:

- Create an electronic system for online transactions without the need for a financial institution or third party

- Maintain an un-editable ledger (“the blockchain”) no one can alter to eliminate double-spending and other accounting shenanigans

Problems with the current monetary system

All government currencies are fiat money. Fiat money exists as legal tender because the government deems it to be so through laws and regulation. The government and its banks are a centralized authority tasked with issuing the currency and who control its supply. This means a government can decide when and how much to inflate the currency supply, without asking permission or getting approval from its citizens.

After the bailouts of 2008, it was discovered through a partial audit of the Federal Reserve (the US Central Banking Authority), that the Fed “printed” over $16 trillion dollars in new money to send to US and offshore banks, companies and individuals.

Inflation in a monetary supply negatively affects your purchasing power with the dollars (or other currency) you already have.

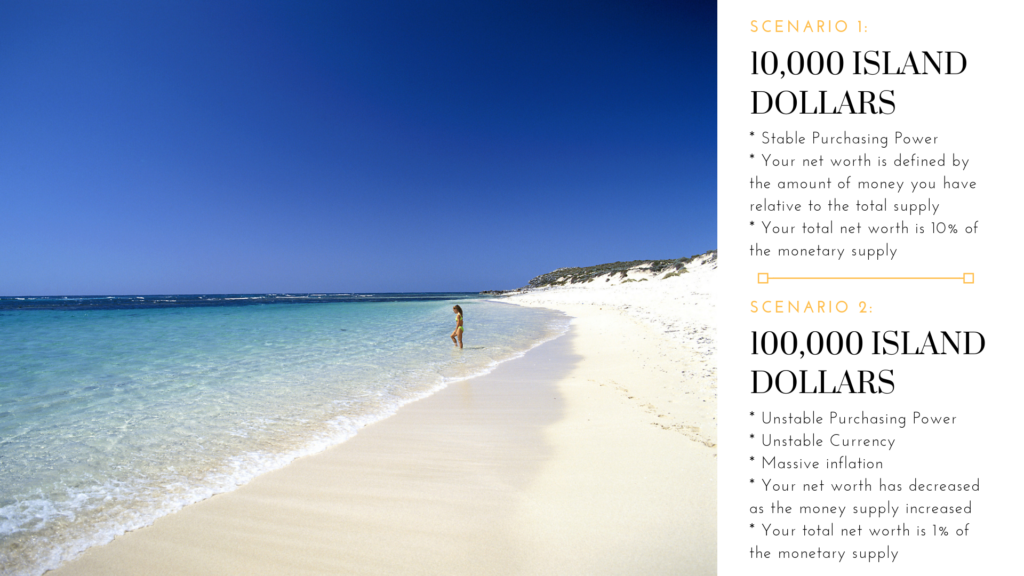

Imagine you and 8 other people live on a desert island that has a monetary supply of 10,000 Island Dollars. You each have 1,000 Island dollars and the government keeps 1,000 on hand for their expenses. Fortunately with no paved roads and only 10 people, the Island has very low taxes.

You and the other island inhabitants generally know about how much goods and services will cost because the money supply is relatively stable. You can also accurately gauge your net worth based on the amount of Island dollars you have with respect to the total supply.

Now consider what would happen to your purchasing power and net worth if the government of the Island decided to change the money supply from 10,000 total Island Dollars to 100,000 Island Dollars.

Instead of your net worth being 10% of the total supply on the Island, your net worth has now plummeted to 1% of the total monetary supply on the Island.

Because there’s more money in circulation, you need more of it to buy the same things. And, your relative net worth will have decreased because you now have a smaller percentage of the total Island Dollars in circulation.

Fiat money works much the same way.

The only problem is that we never know the total amount of money in circulation and the Fed can print up more money without disclosing it to anyone. Finally, remember that in our digital age printing presses are no longer needed to increase the money supply. The Fed can simply add a few zeroes to the total money supply and create new money literally out of thin air.

When inflation gets out of control, a country may experience hyperinflation or a total currency collapse. And lest you think this is impossible, consider that over 28 countries in the last 25 years have experienced hyperinflation. At the height of it’s hyperinflation, it only took 15 hours for prices to double in Hungary. Citizens were literally taking money by the wheelbarrow-full just to buy bread and other items. Soon after, the currency was burned to keep citizens warm.

With the growing distrust in a centralized banking system, and a movement toward online payments, citizens around the world have looked to a better way to transact with each other.

The Bitcoin and cryptocurrency solution

Bitcoin is the first decentralized digital currency. However, different from other past digital currencies, Bitcoin solved a few very important problems in creating a sound digital money supply.

Previous digital currencies had yet to solve the “double-spending” problem. Digital files such as music, photos, and documents can be copied and duplicated. This presents a problem when creating a currency as a supply can be duplicated can be inflated. In a cash transaction, you hand the bills to the merchant and the transaction is complete and cannot be reversed.

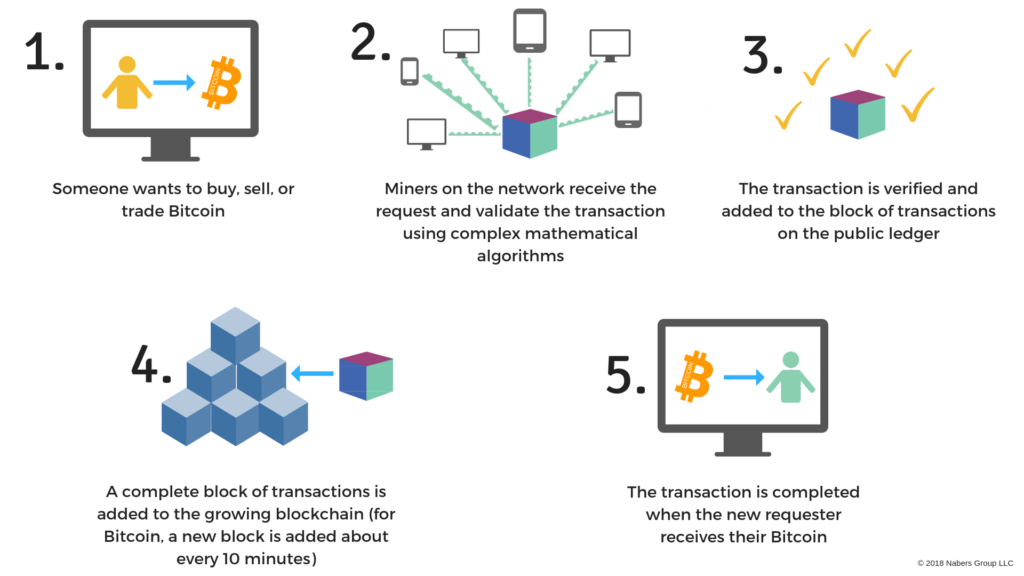

Using theories of cryptographic encryption, Nakamoto created the “blockchain” “…a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions.” The blockchain is a timestamped ledger of all historical transactions, which cannot be altered. The ledger is publicly visible and verifiable, all without disclosing the private information of the parties involved in each transaction. The blockchain is a computer program, run on thousands of computers around the world at the exact same time. This solves the problem of a centralized authority having total control over the money supply and transaction history. Because the blockchain is distributed among its users (also called “miners”), the blockchain is decentralized. When something is decentralized, there is no one attack surface. This also makes the blockchain much more protected against hackers. Even if a single computer running the Bitcoin blockchain is hacked and taken offline, the historical ledger and computer code running the blockchain will remain untouched on the other thousands of computers running the Bitcoin blockchain around the world.

In essence, the invention of Bitcoin created transparency, accountability, privacy and a sound digital currency supply.

How is Bitcoin created?

Most cryptocurrency is created through mining. Mining is a process of validating transactions on a public immutable ledger (the blockchain) by having computers solve complex mathematical equations. For their effort, “miners” are rewarded with cryptocurrency.

On a practical level, this involves having a high tech computer (known as a mining rig) connected to the Internet to run a blockchain. In the early days of Bitcoin, miners could run the bitcoin blockchain on their home computer and were rewarded with multiple bitcoin per day. This contributed to the rise of early “Bitcoin Millionaires”.

Anyone with the proper computer hardware and access to an Internet connection can be a miner.

As more coins are mined, the reward decreases over time. This means it takes more electrical power and more work for the computer to generate cryptocurrencies for helping to create and maintain the blockchain.

The Law of Supply and Demand

Bitcoin functions similar to gold in that only a certain number of bitcoin will ever exist. Like gold, bitcoin cannot just be created out of thin air.

Many cryptocurrencies have a fixed supply over which no more of the token can be created or mined. This fixed supply creates a demand (and price) for the cryptocurrency. Only 21 million bitcoin will be mined in total. That might sound like a lot, but as of today’s writing, over 16 million bitcoin are already in existence.

Like gold, if bitcoin is destroyed it cannot be recreated. This fixed supply has created a large demand for bitcoin. It also means that the miners have to work harder for a smaller reward.

The future of Bitcoin and cryptocurrency

As Bitcoin’s popularity grows, more services are available to purchase and store your Bitcoin. As of late 2017, the popular cryptocurrency exchange platform Coinbase had over 13 million users. While it used to be complicated and cumbersome to buy Bitcoin, you can now do it with ease from your smartphone or home computer. Continued development in computer sciences has allowed the ecosystem around Bitcoin and cryptocurrencies to flourish, with websites and apps such as internet browsers, social media networks, and even fundraising platforms all to be built on top of blockchains.

Bitcoin increased in value over 1,318% in 2017 while the S&P 500 returned around 21.14% in 2017. Bitcoin has increased over 16 million percent in value since it’s inception ten years ago. The total cryptocurrency market value is hovering around $200 billion, and while price fluctuations are normal and to be expected in this young asset class, many investors have made handsome returns from their investment into this exciting investment space.