The blockchain is a digital ledger where transactions are recorded publicly and chronologically. The blockchain is “open source” computer code, which means anyone can see it, read it, attempt to alter it, hack it, or change it. Every time a transaction is made on a blockchain, it is recorded. Anyone can run the bitcoin blockchain protocol on their computer. Thousands of computers distributed across the world are all running the Bitcoin blockchain computer program at once, meaning there is no single point of failure due to server crashes, power outages, etc. In other words, the blockchain never turns off.

When enough transactions are recorded on a “block”, it becomes part of a blockchain and a new block begins. The entire historical blockchain of every single bitcoin transaction in existence is recorded on this immutable ledger.

This creates a layer of transparency in accounting and transacting the world has never experienced before.

The concept of the blockchain was introduced in the release of Satoshi Nakamoto’s white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System. In the paper, Nakamoto announced the arrival of Bitcoin – a digital currency built on a peer-to-peer computer protocol that was completely decentralized. This revolutionary innovation was heralded by cryptographers and computer scientists as the creation of the first private, but publicly verifiable way for parties to transact without a third-party intermediary.

The underlying computer protocol of Bitcoin is the blockchain. The introduction of the blockchain proved to solve several accounting problems and create a trustless form of transactions.

Eliminating double spending

Digital assets can be duplicated and copied. Think about music, image, or document files on your computer and how easy it is to copy them. In order for Bitcoin and cryptocurrencies to function as a stable money supply, they cannot be easily copied where they could be spent twice. The blockchain avoids this duplication with a distributed ledger that is publicly visible. Because the ledger exists on multiple computers across the network, there is no “source” file to be corrupted, duplicated, or altered. Each “node” (computer) running the Bitcoin blockchain has a copy of the same ledger, providing a full audit of all Bitcoin transactions across the network on the blockchain.

In the Bitcoin blockchain, double spending is avoided by a concept call Proof-of-Work. Proof of Work was defined in 1993 by Cynthia Dwork, a Harvard computer scientist. While Proof of work (POW) was not a new concept when incorporated into Nakamoto’s white paper, the way he wove POW and other cryptographic signatures into his distributed ledger was a truly new innovation.

Proof of Work requires those running “nodes” (computers) to solve complex and expensive mathematical calculations in order to facilitate a transaction on the blockchain. The individuals running the nodes are called miners. The first miner to solve the complex mathematical equation receives a reward in the form of transaction fees and newly mined cryptocurrencies. Proof of Work allows for trustless and distributed consensus. The system is trustless because it doesn’t require third-party intermediaries (such as central banks or credit card companies) and distributed because thousands of miners run nodes on a network across the world.

In other words, because everyone has a copy of the blockchain ledger, and because anyone can directly verify the information written into the blockchain by running their own node, no one has to trust in third parties to ensure the transaction happens properly or is recorded so the money can’t be spent twice.

Trustless transactions and solving the Byzantine General’s Problem

In a trustless system unlike one we’ve experienced before, certain important questions need to be addressed:

- With everything distributed among thousands of computers across a network, how does anything get done?

- Who makes the decisions?

- How do you make sure that multiple parties, who are separated from one another, are in full agreement before an action is taken?

- And how can you trust them to keep their word?

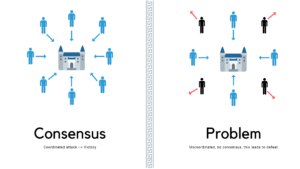

Simply put, how do you reach consensus (where everyone agrees and keeps his word) so you can get things done?

In computer science this is known as the Byzantine General’s Problem (or the Byzantine Fault Tolerance). The scenario is as follows:

Imagine a group of Byzantine generals who have surrounded a city. Some want to attack, some want to retreat. In order to be successful, they must arrive at a consensus (e.g. all attack, all retreat, all attack on a specific day at a specific time, etc). However, the generals have three distinct problems:

- The generals are far apart with no centralized authority, so a coordinated attack is challenging

- The only way the Byzantine generals can win is if they all make a coordinated effort together 100%

- The generals do not trust each other

The Proof of Work protocol as described above solves the Byzantine General’s problem by allowing all the generals (nodes/computers on the blockchain) to achieve consensus and then have to stick with their vote. They cannot change their minds or undermine one another.

The solution to the Byzantine General’s Problem isn’t simple by any means. It involves complex computing work, hashing (a form of cryptography) and communication between all the nodes (generals) on the blockchain network.

Decentralization and distributed ledgers

Imagine you have a spreadsheet that is copied thousands of times across a network of computers all over the world. Then imagine that this network is structured to update the spreadsheet at regular intervals. No one person who has the spreadsheet can change it. Even if they figured out how to change the spreadsheet on their computer, it would remain untouched on the thousands of other computers around the world.

This is the basic idea of blockchain, decentralization and the distributed ledger.

The information that exists on the blockchain is a shared, and continually updated database. The database isn’t stored in any one location, or on any one computer. This eliminates the possibility of fraud in any accounting reconciliation, it reduces (or eliminates) the threat of hacking into a single database, and eliminates a single point of failure should the computer become unusable. Centrally maintained data risks are eliminated with a blockchain because the data is stored across its entire network. Further, because the records are held in multiple locations, they are publicly visible and easily verifiable.

This also creates a level of durability in the blockchain as it is not easily corrupted or controlled. The blockchain exists in a state of consensus and automatically self-audits every ten minutes through verification of new transactions added to the blockchain in “blocks”.

Who will use the blockchain?

Financial Organizations: As blockchain technology and cryptocurrencies gain popularity, more sectors are beginning to see how the distributed ledger protocols can have distinct advantages in their own businesses. Certainly the financial sector offers the most compelling case for the new technology. The World Bank estimated over $613 billion in money transfers in 2017 and stated:

Major barriers to reducing remittance costs are de-risking by banks and exclusive partnerships between national post office systems and money transfer operators. These factors constrain the introduction of more efficient technologies—such as internet and smartphone apps and the use of cryptocurrency and blockchain—in remittance services.

(Source)

Both JP Morgan and Goldman Sachs have announced their interest in developing Bitcoin trading desks as an imminent strategy for their firms.

More than 2 billion people in the world are unbanked or don’t have access to bank accounts. The possibility for the use of Bitcoin, blockchain and other cryptocurrencies would bring the ability to transact on a global scale never before seen.

Data Security: Data security firms show increasing interest in blockchain technology due to the distributed and decentralized nature of the protocol. This would eliminate a central point of failure and greatly reduce the hacking risks, thus providing less exposure to private or sensitive data. Storing data on the blockchain is incorruptible, which also makes it an attractive (and more secure) option than simply storing the data in the cloud.

Smart Contracts: One element of distributed ledgers is such that simple contracts can be coded that auto-execute once specific conditions are met. The Ethereum network and blockchain were developed by Vitalik Buterin to fulfill just this purpose. With the development of smart contracts, multiple ares of our culture and economy can create new business applications…

Sharing Economy: Companies like Uber and Airbnb have already proven the success of the sharing economy. But Uber and Airbnb still function as a third-party intermediary. Blockchain technology in the space could enable direct peer-to-peer transactions and payments, thus eliminating the third-party fees and potential delays. And because of the trustless nature of the distributed blockchain, the transaction would protect both parties to ensure they receive what was promised. One project, OpenBazaar uses blockchain technology like a peer-to-peer eBay, all without transaction fees.

Real Estate: Based on the protocol of smart contracts, many real estate contracts could be completed via the blockchain. This could eliminate delays from title companies or even underwriters. If a buyer’s assets are recorded on a blockchain and can be verified without falsification, once that buyer finds a home to buy, the title can also be placed into a blockchain powered escrow service. The smart contract can be coded to release the title to the new owner as soon as funds are received by the seller. The entire contract could execute with no transaction fees and at a fraction of the time of a traditional real estate transaction in our current third-party intermediary system.

Healthcare: If you’ve ever changed doctors, you can know that getting a copy of your healthcare records can be an arduous process. But, if your identity were stored privately and encrypted on a blockchain, the new healthcare provider would be able to access a copy through a simple smart contract you execute with the new provider. Blockchain distributed ledgers can provide enhanced methods for proving your identity, in addition to the ability to digitize personal documents, making document transfers much less cumbersome.

Governance/voting: If the results of a vote were recorded on a blockchain distributed ledger, they would be completely public and unable to be altered. This could bring a new level of transparency to voting, both in governance and even corporate board decisions. The app Boardroom, currently allows an organization into integrate blockchain governance into voting procedures. Japan is also currently experimenting using blockchain powered technology in their voting.

Once you begin to open to the possibilities of the blockchain protocol, it’s easy to see how almost every industry can be affected, or disrupted by this new technology. Blockchain protocol can increase efficiency, reduce waste and make transactions happen more quickly. As more use cases are discovered, the proliferation of blockchain technology continues to grow.