Academia joins the ranks as the latest institutional investors to join in crypto investing. Reportedly, the endowments of Harvard University, Yale University, Stanford University, Massachusetts Institute of Technology (MIT), Dartmouth College and the University of North Carolina have all begun investing in one or more crypto funds.

While investment banks and other legacy financial institutions like Fidelity are making moves into crypto investing, this marks the first public show of support from a group of major universities. Many believe an investment from such a historic endowment is a sign that further institutional investment is nearing.

Major money shows major support

Harvard is reported to have the largest university endowment in the world. The endowment supports one-third of the university’s operating budget and reported a value of almost $40 billion in 2018.

While Harvard’s endowment is the largest, Stanford came in fourth and MIT ranked sixth in a 2017 report of the country’s 25 largest endowments. The University of North Carolina and Dartmouth were also listed in the top 25.

Traditionally, university endowments include a smaller allocation into traditional stocks and bonds and a larger allocation to non-traditional alternative assets. These assets may be hedge funds, venture capital, private equity, and even commodities like oil and natural resources.

The show of support from Ivy League and technology-focused universities may signal to some that institutional investing is getting more comfortable with crypto as a new asset class.

Yale University Endowment Invests in Two Digital Asset Funds

Yale University’s endowment recently made its first investments in the cryptocurrency market as well. The endowment is the second largest in the country, at just under $30 billion. Two different crypto-focused funds have received investment, CNBC reported last week. The funds are a16z, run by Andreessen Horowitz and Paradigm, which was started by Coinbase co-founder Fred Ehrsam, former researcher at Pantera Capital Charles Noyes, and former Sequoia Capital partner Matt Huang.

David Swensen, nicknamed Yale’s “in-house Warren Buffett” according to its alumni magazine, manages the university’s endowment. The two investments currently represent a tiny portion of the billions in the endowment. However, profitable returns could convert some crypto deniers into crypto investors.

Crypto Classes Popular in University Course Catalogues

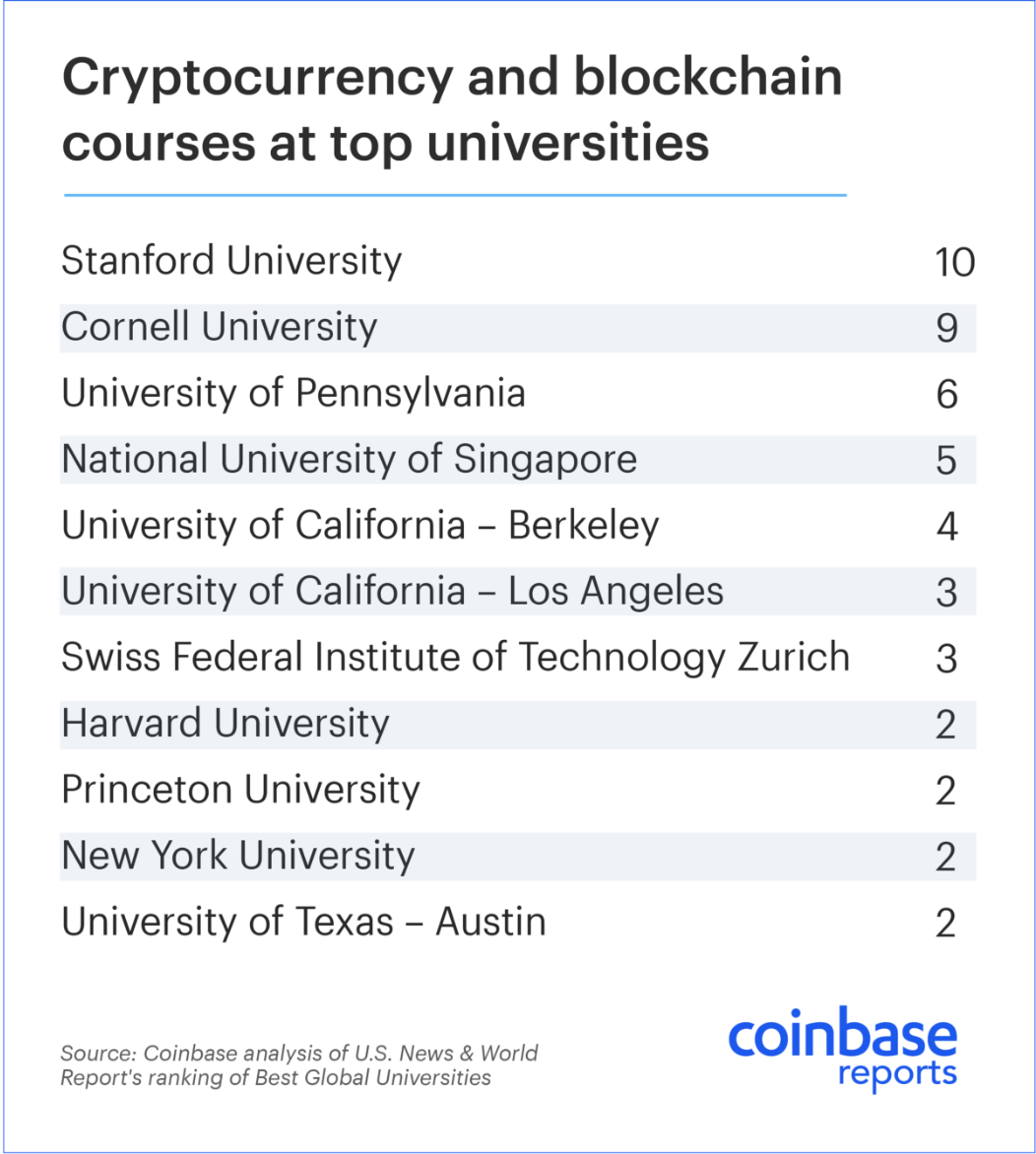

Academia is showing further support of the new asset class by offering classes on crypto and blockchain. According to a report from Coinbase and Qriously, 42 percent of the globe’s top 50 universities offer at least one course on cryptocurrency or blockchain technology (read the report here).

New York University started offering a course on blockchain and financial services in 2014. At the time, 35 students enrolled in the class. By spring 2018, over 230 students enrolled, causing the class to move to the largest auditorium on campus. In the coming academic year, course creator David Yermack will offer the course both semesters to meet student interest.

Stanford and Cornell rank among the universities offering the most crypto-focused classes.

Universities around the world continue to show support for crypto and blockchain technology education and adoption. The Lucerne University of Applied Sciences and Arts in Switzerland announced the decision in late 2017 to accept Bitcoin payments for tuition payments.

Research interest in blockchain technology and Bitcoin continues to bloom as well. MIT, Cornell, and Columbia, are launching research centers and labs to explore blockchain technology and its implications on public policy. In 2017, Cambridge University released the Global Cryptocurrency Benchmarking Study, an extensive research project partially funded by Visa.

The entree of academia into the crypto market, through direct investing, research and education is another indicator that institutional money is ready and willing to explore Bitcoin, crypto, and blockchain further.

Leave a Reply