The Intercontinental Exchange (ICE) has launched Bakkt, a company that aims to offer a federally regulated market for cryptocurrencies. ICE owns the New York Stock Exchange.

ICE is a leader in global exchanges, clearing houses, and data and listing services. In addition to the gravity of a major Wall Street player investing in the crypto market, Bakkt also aims to bring regulation to the space. Bakkt hopes protect crypto users by providing government regulated custodian service as a part of their offering. Until now, regulated physical custodian services have been absent in the marketplace making some institutional investors gun-shy about investing.

In a press release from August 3rd, ICE announced it’s plans to “create an open and regulated, global ecosystem for digital assets“. Bakkt will be an open, yet completely regulated crypto platform, powered by Microsoft Azure’s cloud solution.

Bakkt and Institutional Investors

It’s long been said that for crypto to go “mainstream”, it has to have the support of institutional investors. Institutional investors include pension funds, endowments, foundations, major hedge funds, or even investment banks and brokerage firms. Bakkt hopes to fill this void and provide welcome entry for institutional investors. Jeffrey C. Sprecher, the Founder, Chairman and CEO of Bakkt and Chairman of ICE stated:

“In bringing regulated, connected infrastructure together with institutional and consumer applications for digital assets, we aim to build confidence in the asset class on a global scale, consistent with our track record of bringing transparency and trust to previously unregulated markets” (Source)

The backing of ICE and, by extension, the NYSE bring a great deal of legitimacy to the cryptocurrency market for the mainstream investor.

Additionally, Bakkt aims to overcome some notable hurdles of crypto investing, including security of assets and custodianship. Once this hurdle is overcome, institutional investors can more safely invest billions, if not trillions into the burgeoning crypto market.

Asset Security

Safe custodianship of traditional assets like shares, bonds, and commodities has been solved through clearing houses and qualified custodians. Until now the cryptocurrency and digital asset market didn’t have a qualified custodian solution. Horror stories have unfolded all over the internet about investors losing their holdings due to hacking, or even a forgotten password. With significantly more assets at stake, institutional investors have to take greater precautions.

Some exchanges like Coinbase or Gemini offer custody solutions, but they lack federal regulation which means larger pension funds, endowments, foundations, hedge funds, and the like are not going to entrust them with billions in assets.

Why this matters to the crypto market

The inclusion of a Wall Street powerhouse in the trading and custodianship of cryptocurrency can have a massively positive impact on digital assets like Bitcoin.

It’s true the Bitcoin futures market already has a powerful exchange in its corner. The Chicago Board Options Exchange (CBOE) released a Bitcoin futures product in November 2017.

However, institutional investors didn’t jump on board with the CBOE futures market as many had hoped. CBOE Bitcoin futures are settled in cash, which is a contributing factor to the lack of adoption. When a futures contract is settled in cash, there is no actual Bitcoin exchanged in the settlement of the futures. Pricing inefficiencies and arbitrage are also byproducts of the lack of physical delivery in the Bitcoin futures markets.

Physical Futures Product

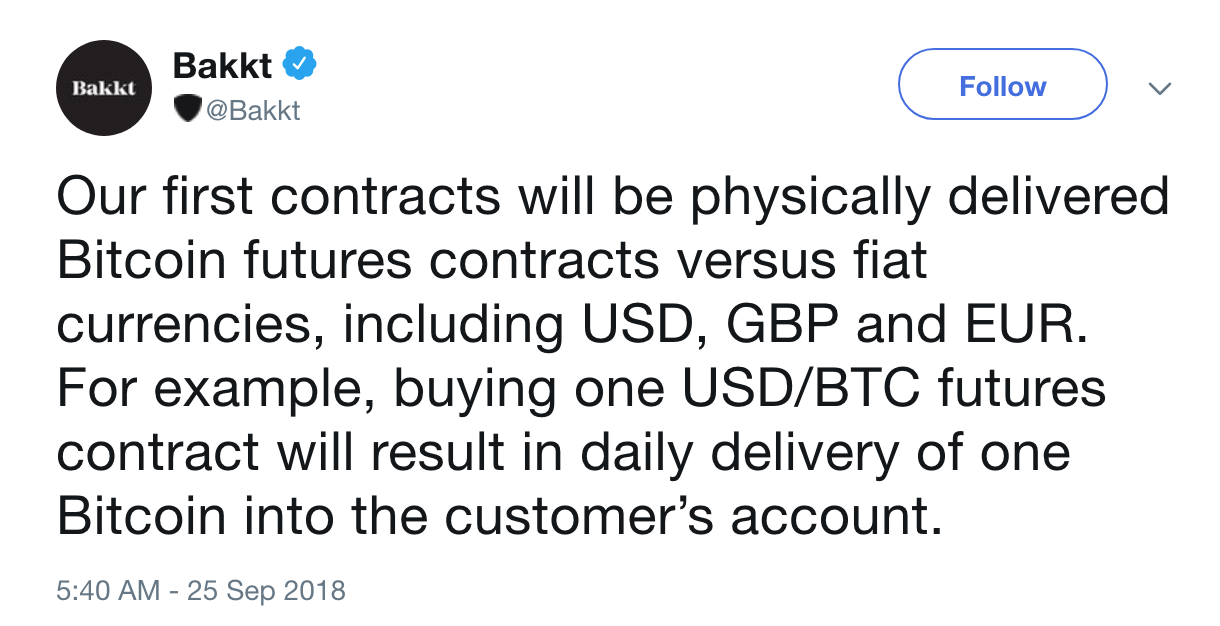

Bakkt has had physical settlements as a part of their plan since the beginning. As stated in their initial press release:

As an initial component of the Bakkt offering, Intercontinental Exchange’s U.S.-based futures exchange and clearing house plan to launch a 1-day physically delivered Bitcoin contract along with physical warehousing in November 2018, subject to CFTC review and approval. These regulated venues will establish new protocols for managing the specific security and settlement requirements of digital currencies. (ICE Announces Bakkt, released August 3, 2018)

The physical futures contracts will be settled in Bitcoin. This means parties involved in the trades will transact in Bitcoin. This is an incredible step toward developing trust of the asset in the market. In a recent post on Medium.com, CEO Kelly Loeffler stated the firm does not plan to allow clients to trade on margin or put paper claims on these real assets.

Loeffler continues, “A critical element to price discovery is physical delivery. Specifically, with our solution, the buying and selling of Bitcoin is fully collateralized or pre-funded. As such, our new daily Bitcoin contract will not be traded on margin, use leverage, or serve to create a paper claim on a real asset. This supports market integrity and differentiates our effort from existing futures and crypto exchanges which allow for margin, leverage and cash settlement.” (An Evolving Market, the Need for Trusted Price Formation)

In a tweet released on September 27th, Bakkt representatives further solidified the real Bitcoin-backed product stating:

This is a monumental step in increasing both the visibility of cryptocurrency in the mainstream financial space, and in allowing regular people to transact using Bitcoin as the medium of exchange.

Physically settled Bitcoin futures contracts also provides a faster and more positive feedback loop for larger adoption. Like with the Internet and early email, more users means problems or bugs can be discovered and solved more quickly.

Finally, the physically settled Bitcoin futures contracts may have a hand in creating more price stability for cryptocurrencies. Crypto is a notoriously volatile market. The extreme price movements have created wealth for some, and substantial losses for others. The crypto market movements confound even the most seasoned traders making investors wary to enter. As more investors enter crypto through a regulated Bitcoin futures platform, the price may begin to stabilize as well. This creates a “flywheel” effect where more investors stabilize the price, which leads to increased adoption, which leads to increased investor activity, further price stabilization, and so on.

Great article Rachel. It seems the fundamentals are all there lining up for a big spike in the crypto markets, namely Bitcoin. I sure wish some of these underlying fundamentals would hurry up and translate into that actual upward movement. My hope is that Bitcoin isn’t taken over so much by the institutions as it seems to be already, whereby they manipulate and suppress the price, much like they have done in the gold and silver markets for decades now. The Goldbugs have been waiting for over a decade now for that big move, I hope this isn’t the fate of Bitcoin.

Thanks for your feedback, Chuck! I think the distinction from gold and Bitcoin is the decentralization and distributed public ledger. No one truly knows how much gold is in Ft. Knox or physically held by government vaults. Because of the public ledger, it’s much more difficult (maybe impossible or impossibly expensive?) to manipulate the entire public blockchain for Bitcoin to be manipulated. Further, with the Bakkt futures market having physically redeemable Bitcoin, which Gold ETF’s do not, the chances of manipulation decrease further.